Key Takeaways

Virginia presents a compelling case for international expansion, blending historic fiscal consistency with modern infrastructure. For foreign entities, this stability minimizes risk when establishing U.S. subsidiaries.

- Predictable Corporate Stability: Virginia maintains a 6% flat corporate tax rate—a policy unchanged since 1972. This consistency is crucial for foreign investors accustomed to volatile tax regimes elsewhere.

- Global Logistics Hub: Home to The Port of Virginia (3rd largest on the East Coast) and Washington Dulles International Airport, the state offers direct supply chain and travel links essential for international trade.

- Elite Talent Pipeline: The “Virginia Talent Accelerator Program” is ranked #1 in the U.S., providing customized workforce training that allows foreign companies to scale operations rapidly with skilled local labor.

- Strategic Visa Pathways: Due to its economic density and business-friendly regulations, Virginia is a prime jurisdiction for L-1 Intra-Company Transfers, E-2 Treaty Investors, and EB-5 Direct Investment cases.

Ranked as “America’s One of the Top States for Business” by CNBC (2025), Virginia offers a unique “safe harbor” for capital: a stable 6% corporate tax rate unchanged for 50+ years, the world’s largest data center market, and the East Coast’s most efficient, semi-automated port network. It is the only state that combines direct access to Washington D.C. policymakers with a pro-business regulatory environment.

The “Virginia Advantage”: Stability in a Volatile Market

In an era of fluctuating tax codes and regulatory uncertainty, Virginia markets itself on predictability. While other states wrestle with budget deficits and tax hikes, the Commonwealth has maintained a 6% corporate income tax rate for over five decades.

For foreign investors, this stability is compounded by Virginia’s status as a Right-to-Work state. This designation provides significant labor cost certainty, a critical factor for heavy industries such as the advanced manufacturing clusters seen in the Interstate 81 Corridor.

Virginia essentially functions as a ‘risk hedge’ for international portfolios. You get the proximity to the federal government without the regulatory heaviness often associated with the D.C. metro area.

Logistics & Infrastructure: The Supply Chain Backbone

The state’s infrastructure is designed to move goods faster than any competitor on the Eastern Seaboard.

The Port of Virginia

Unlike landlord ports where terminals compete against each other, The Port of Virginia operates as a single entity. It features the deepest and widest channels on the U.S. East Coast, capable of handling Ultra-Large Container Vessels (ULCVs).

- Capacity: The port is currently undergoing a $1.4 billion expansion to accommodate future trade volumes.

- Automation: Cited by World Distribution Services as the most technologically advanced port in North America.

- Sustainability: It is powered by 100% clean energy, aligning with the ESG mandates of European and Asian investors.

Washington Dulles International (IAD)

For executives and high-value cargo, IAD provides non-stop access to over 50 international destinations. This connectivity is vital for managing Foreign Direct Investment (FDI) relationships, allowing headquarters in Frankfurt, Tokyo, or Seoul to maintain close oversight of Virginia operations.

Key Growth Sectors: Where the Money is Flowing

Virginia’s economy is no longer just about government contracting. It has diversified into three high-velocity sectors:

“Data Center Alley” (Loudoun County):

Virginia processes an estimated 70% of the world’s internet traffic. For tech investors, the infrastructure here—fiber density, power reliability, and tax incentives for equipment—is unmatched globally.

Advanced Manufacturing:

Recent investments by the LEGO Group (building a carbon-neutral factory in Chesterfield County) and Volvo Trucks demonstrate the state’s capacity for large-scale industrial projects.

Biopharma & Life Sciences:

The Petersburg/Richmond cluster has emerged as a critical node for essential medicine manufacturing, supported by federal grants to reshore pharmaceutical supply chains.

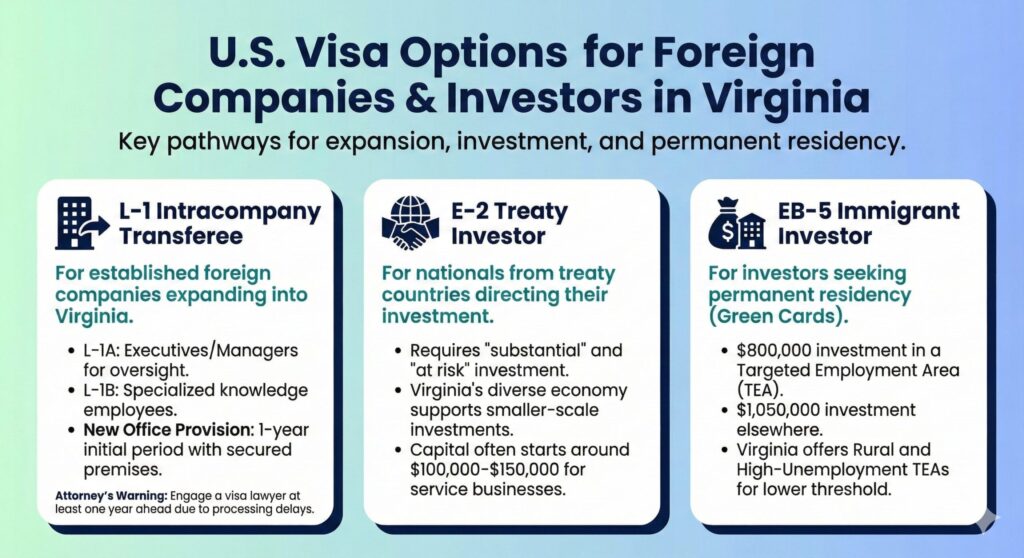

Legal Framework for Foreign Investors: Visa Pathways

Navigating U.S. immigration law is often the highest hurdle for foreign capital. Virginia’s economic landscape is specifically structured to support both treaty-based and corporate transfer visas.

The L-1 Intracompany Transferee Visa

The L-1 visa is the primary vehicle for established foreign companies expanding into Virginia. It allows multinational corporations to transfer key personnel from a foreign branch to a U.S. subsidiary.

- L-1A (Executives/Managers): Allows senior leadership to oversee the new Virginia operation.

- L-1B (Specialized Knowledge): Critical for transferring employees with proprietary knowledge of the company’s products or processes.

- The “New Office” Provision: If you are establishing a new office in Virginia, the L-1 allows you to send an executive for an initial one-year period to get operations running, provided you have secured physical premises (a lease).

The E-2 Treaty Investor Visa

The E-2 visa allows nationals from treaty countries (e.g., Turkey, UK, Japan, Taiwan) to direct and develop their investment in the U.S.

- Virginia’s Edge: The state’s diverse economy allows for smaller-scale E-2 investments in sectors like IT consulting, logistics franchises, and hospitality.

- Requirement: The investment must be “substantial” and “at risk.” In Virginia, capital injections often start around $100,000–$150,000 for service-based businesses, provided they generate local employment.

The EB-5 Immigrant Investor Program

For investors seeking permanent residency (Green Cards), the EB-5 program requires investing $800,000 in a Targeted Employment Area (TEA) or $1,050,000 elsewhere.

- Rural TEAs: Virginia offers numerous rural TEAs (outside the D.C./Richmond metro areas) where the lower investment threshold applies. These projects often receive priority processing from USCIS.

- High-Unemployment TEAs: Parts of the manufacturing belt in Southern Virginia qualify as high-unemployment TEAs, making them eligible for the $800,000 investment cap.

Workforce: The #1 Ranked Talent Accelerator

A common bottleneck for FDI is finding skilled labor. Virginia solves this with the Virginia Talent Accelerator Program.

- Ranking: Rated the #1 customized workforce training program in the U.S. by Business Facilities.

- Mechanism: The state provides fully customized recruitment and training services at no cost to qualified companies creating new jobs.

- Veteran Pipeline: Through the V3 (Virginia Values Veterans) program, investors can tap into a highly disciplined workforce of retiring military personnel, many of whom possess security clearances—a major asset for defense and tech contractors.

Comparative Analysis: Virginia vs. Competitors

For site selectors, the decision often comes down to the numbers. Here is how Virginia compares to other major FDI destinations.

| Metric | Virginia | New York | California | Texas |

|---|---|---|---|---|

| Corp. Income Tax | 6.00% (Flat) | 6.50% – 7.25% | 8.84% | 0% (but high Gross Receipts Tax) |

| Right-to-Work | Yes | No | No | Yes |

| Cost of Doing Business | Moderate | Very High | Very High | Low/Moderate |

| Utility Costs (Industrial) | Below Nat’l Avg | High | Very High | Variable |

| Top Talent Program | #1 Ranked | Top 10 | Top 10 | Top 5 |

Conclusion: Your Roadmap to Entering the Commonwealth

Investing in Virginia is a strategic play for stability and access. Whether utilizing an L-1 visa to transfer your best engineers to a new HQ in Reston, using an E-2 visa to launch a logistics franchise, or deploying EB-5 capital into a manufacturing plant in the Shenandoah Valley, the Commonwealth provides the legal structure and physical infrastructure necessary for growth.

Next Steps for Investors:

- Site Selection: Evaluate TEAs if pursuing EB-5 or “New Office” requirements for L-1.

- Entity Formation: Register your LLC or C-Corp with the Virginia State Corporation Commission.

- Incentives: Apply for the Commonwealth’s Opportunity Fund (COF) before signing a lease.

If you are planning to invest in Virginia, you can contact us to evaluate the legal and strategic aspects of the process.

Disclaimer: This article is for information only and is not legal advice. Laws can change. Always speak with a qualified attorney.